Vietnam’s recently adopted power plan shows the determination of the Vietnamese government’s commitment to the green energy transition.

But there are more challenges to diversifying its energy mix than just rubbing the coal dust from its eyes.

The power plan, dubbed PDP8, was adopted last month after two years of delays and a slew of drafts were drawn up. It outlines a roadmap for country’s energy mix until 2030, with the country’s goggles firmly planted on greener pastures.

“The adoption of the PDP8, after several years of discussions, is a positive signal and shows the strong political determination of the Vietnamese government to diversify the national electricity mix [and] reduce coal-fired power generation,” Dimitri Pescia, an energy analyst, told Diplomatic Network (Asia) in an interview.

Pescia, who is the Southeast Asia programme lead at energy think-tank Agora Energiewende, added that the plan is a step in the right direction for the Southeast Asian country which is aiming to reach net-zero emissions by 2050.

The plan is to slowly push the breaks on the country’s dependence on coal, while revving up generation from wind and gas.

In 2022, Vietnam drew 38% of its electricity production from coal; another 38% from hydro; 11% from gas; 10% from solar; and 3% from wind, according to Oxford-based data portal Our World in Data.

PDP8 plans to increase wind production to around 19% of its total energy mix by 2030. It has also set out to grow liquified natural gas production to 15%, while cutting its reliance on coal to 20%.

There will likely be some bumps in the road though, Pescia said.

“The main challenge concerns the potential misalignment between this plan and the goal to peak yearly emissions to 170 metric tonnes of CO2 [equivalent] in 2030 as agreed under the Just Transition Partnership between Vietnam and the International Partners Group,” he said.

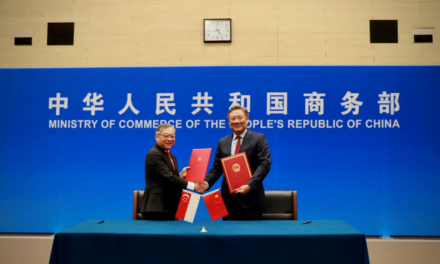

At the end of last year, Vietnam inked an agreement with developed nations, called IPG, to unlock financing and support for its transition towards carbon-neutrality.

IPG consists of the European Union, the United Kingdom, France, Germany, the United States, Italy, Canada, Japan, Norway and Denmark.

The partnership aims to mobilise USD15.5 billion of public and private finance, over the next three to five years to support Vietnam’s green transition.

Before the agreement, Vietnam was planning to hit peak MtCO2 equivalent emissions in 2035, at 240 MtCO2e. Under the JETP agreement that target has been lowered to 170 MtCO2e by 2030.

After PDP8 was rubber stamped, the JETP target may pose more of a challenge, Pescia said, due to its still heavy reliance on dirtier sources of energy.

“In particular, the PDP8 foresees an important role for natural gas-fired power plants, as well as for coal-fired power plants blended with fuels such as ammonia. This approach is uncertain – economically, technologically and from a sustainability perspective. It also presents an important risk of stranded investments,” Pescia said.

Ammonia is a carbon-free fuel source as it does not contain carbon atoms. When used as a blending agent or co-firing fuel in coal power plants, ammonia can potentially reduce the net CO2 emissions associated with coal combustion.

According to PDP8, about 50% of the total installed capacities in 2030 should be renewables. This installed capacity will represent between 30% to 40% of the power generation, Pescia said, with 12% to 19% coming from variable renewables such as wind and solar power.

“Looking at it from this perspective, the plan is not sufficiently ambitious if the country wants to meet the objectives set in the JETP,” Pescia said.

Contrasting with Pescia’s view, Global Energy Monitor said in a note released in June that PDP8 appears to align with the JETP agreement. Specifically, it seems to align on the expectation that the country would reach peak emissions by 2030 rather than 2035.

GEM is a San Francisco-based non-governmental organization which catalogues fossil fuel and renewable energy projects worldwide.

Vietnam has 25.9 gigawatts of operating coal capacity as of May 2023, according to GEM. This number is seen peaking at 30 GW at the end of the decade, in accordance with PDP8, and then declining towards a zero-coal aspiration by 2050.

In light of JETP, Vietnam has been curbing its construction of coal plants to ensure that it meets the JETP agreement.

“Vietnam is expected to install less than 6 GW of additional coal capacity, similar to the 6.1 GW across six coal projects listed as ‘under construction’ in PDP8,” GEM said, adding that a number of coal plants have also been scrapped.

“Eleven projects accounting for over 9 GW of capacity appear to have been officially cancelled in PDP8, while five additional projects were left in limbo and given until June 2024 to either make advancements or be terminated,” GEM noted.

Although this is a commendable effort, Pescia is still doubtful about whether Vietnam’s climate targets are reachable before 2030.

“[PDP8 sees] significantly less [coal use] than under the previous PDP7 plan which foresaw 55 GW of coal power by 2030, but still too much if the government is to meet its climate targets,” Pescia said.

“To comply with the 170 MtCO2e cap adopted in the context of JETP, the Government of Vietnam will need to carefully assess options to reduce the operating hours of those power plants, think about divestment mechanisms, and probably consider renegotiating existing power purchasing agreements.”

Whether or not the JETP peak emissions target is met, PDP8 has solidified Vietnam’s commitment to phase out coal and has brought potential CO2-chugging coal projects to a halt.

“It is important to recognize how far Vietnam has come towards cutting its reliance on coal. Based on a preliminary review by GEM of coal plant proposals still under consideration outside of China in 2023, Vietnam’s latest coal projections means that the country is currently leading the way in proposed coal capacity cancellations this year,” GEM said.

To fill the grubby hole left by coal, PDP8 plans to pass the torch to cleaner fossil fuel LNG. Although, this has its own risks.

“Relying too much on natural gas can be risky, given [the] limited and uncertain domestic resources, as well as price increases and high price volatility on the world market. LNG projects require significant investments into infrastructure that could become stranded once more affordable clean alternatives emerge,” he said.

LNG emits about 40% less carbon dioxide than coal.

In 2020, Vietnam imported about 70% of the total LNG used domestically, according to consulting firm Dezan Shira & Associates. This was up from 55% in 2018.

LNG is still an important component though, as it provides a reliable source of energy when wind and solar energy production wanes due to their variable nature.

“The most immediate task that the government will need to tackle is the adoption of new de-risking mechanisms that encourage investments in renewable projects such as wind and solar power,” Pescia said.

Investments will be vital in paying for PDP8’s USD134.7 billion bill.

This presents a challenge for Vietnam’s purse, as any fiscal extravagance will be reined in by the country’s strict 60% debt ceiling up until 2030.

Last year April, Vietnam’s government said it would cap its public debt at 60% of its gross domestic product until 2030. At the end of 2021, the country’s public debt-to-GDP ratio was around 40%.

This means that the investments from private sector will be key in driving Vietnam’s transition.

“Private sector investments will play a key role, both in building power generation capacity and further developing the power grid,” Pescia said, “Given the scale of the investment needed, regulations and mechanisms required to attract those investments need to be further refined.”

“It will also be crucial to focus on solutions that can minimise long-term investment needs altogether, such as measures to improve energy efficiency or incentives to deploy new power projects closer to the demand centres,” Pescia said.

This comes as Vietnam leads the region’s growth.