Singapore’s economy remained sluggish in the third quarter of the year, the Ministry of Trade & Industry said on Friday.

The manufacturing sector dragged on Singapore’s growth, with gross domestic product expanding 0.7% in the third quarter of 2023 compared to the year prior. This showed a marginal improvement from the 0.5% year-on-year growth in the second quarter.

The recent figures released by the Ministry of Trade & Industry are based on “advanced estimates”, with the final figures being released in November.

On a seasonally adjusted basis, the Lion City saw GDP rise 1.0% quarter-on-quarter, improving upon the 0.1% growth seen in the second quarter.

The manufacturing sector has been weighing on growth. The sector contracted by 5.0% on a yearly basis in the third quarter. This followed a 7.7% contraction in the second quarter.

“The weak performance of the sector was due to output declines across all the manufacturing clusters, except for the transport engineering cluster,” the Ministry of Trade & Industry said.

Meanwhile, the construction sector offered some buoyancy after recording annual growth of 6.0% in the third quarter. This was preceded by a 7.7% expansion in the second quarter.

“Growth was supported by expansions in both public and private sector construction output,” the Ministry said.

Earlier this year, after a poor performance in the second quarter, the Ministry of Trade & Industry reduced its GDP forecast for 2023 to between 0.5% and 1.5% from the previously expected 0.5% to 2.5%.

Singapore’s economy, like many others around the world, has lost a lot of steam this year. The city-state’s GDP grew 3.6% in 2022, so even at the top end of 2023’s forecast GDP range, the city-state will have experienced a significant slowdown.

Clouds are darkening further in the near term with the recently sparked conflict in Israel and Palestine. This has catalysed a rise in oil prices, in fear the conflict may spread beyond Israel’s borders, which will continue to fan global inflation.

This will likely mean interest rates in the US, a key export destination for Singapore, staying higher for longer.

Singapore’s manufacturing sector, which has been a thorn in the side of its economy this year, is likely to be constrained in the near-term as sticky inflation in the US and a sluggish economy in China dampen hopes for improved export demand.

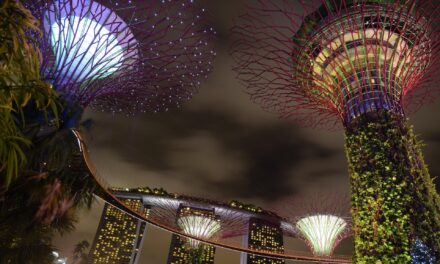

There are some green shoots, however. Returning international tourism in the Asia Pacific region has boosted the accommodation sector with international visitors on the rise.

This is unlikely to make a larger impact on the country’s GDP, with accommodation making up less than a percent of its total. Meanwhile, the manufacturing sector made up 21% of the country’s total GDP in 2022.

It is also possible that China’s economy might be at the bottom of its recent slump. If a swift recovery is enacted, it would open up more demand for Singapore’s goods and services sectors. The Chinese government has shown wariness for opening up the fiscal taps completely though.